By Paul Culp, MA (Oxon.), CFT, GCDF, CCSP

Even if you don’t expect to qualify for federal financial aid, you’ll need to file a federal financial form.

There’s an old saying that the saddest of all possible words are “I’m from the federal government and I’m here to help.” Nonetheless, even the sharpest critics of the government can live with a universal mechanism for the financial aid quest. Contrary to a popular misconception, the money doesn’t come from “the people at FAFSA,” as the Department of Education puts it, but those people do give you a quick turnaround on processing the data that will be used for determining eligibility for all manner of financial aid, including the federal variety.

The Free Application for Federal Student Aid is the form that prospective and current college students, undergraduate and graduate, prepare each year to determine their eligibility for financial aid. Formerly available at the beginning of each calendar year, it now appears on October 1 in order to correspond with the college applications cycle for the upcoming academic year. Families seeking aid for the 2019-2020 school year, for example, would have been able to access the FAFSA in October of 2018.

The FAFSA is for anyone pursuing post-secondary education: undergraduate studies, graduate school, professional schools like medicine or law, and a high percentage of vocational and technical schools. We’ll soon be referring to renewals; that’s because each application is good for only one year.

FAFSA attracts a crowd.

During the 2016-2017 application cycle, the most recent period for which the Department of Education has released complete statistics, a total of 18,741,055 people submitted the FAFSA. Nearly a quarter of applicants were in the “first year, never attended college before” cohort. About half were from families in which neither parent had completed college. More than half were first-time applicants, as opposed to those applying for renewal. Fifty-six percent were eligible for Pell Grants, the primary form of federal aid.

Other forms of federal aid include Federal Supplemental Educational Opportunity Grants (FSEOG), which are awarded to students who demonstrate the greatest need and which often accompany Pell Grants; a variety of loans; and work-study programs.

Far beyond the question of eligibility for federal assistance, however, the FAFSA is used to gather students’ and parents’ financial information and calculate each family’s Estimated Family Contribution (EFC), a measure of the amount the family can reasonably afford to pay for higher education in the coming academic year. States use the EFC in determining whether and how to bestow aid, and individual colleges subtract a family’s EFC from the total cost of attendance at a particular school as part of the process of determining aid amounts.

As the Department of Education explains, “Your EFC is not the amount of money your family will have to pay for college, nor is it the amount of federal student aid you will receive. It is a number used by your school to calculate the amount of federal student aid you are eligible to receive.”

(Hint: Go to The Coaching Educator’s home page and click on the pig at the top. That will take you to our free EFC calculator. Your financial data will not be shared with us or with anyone else.)

Applicants must be U.S. citizens, legal permanent residents, or eligible non-citizens. The latter category includes resident aliens with Green Cards (conditional included) and persons classified by the Immigration and Naturalization Service as refugees, asylum grantees, indefinite parolees, humanitarian parolees, and Cuban-Haitian immigrants. Citizens of Palau, the Marshall Islands, and Micronesia are also eligible. U.S. citizens must have a social security number, and males aged 18 through 25 must be registered for Selective Service. Federal financial aid also requires a high school diploma or GED.

FAFSA: Not quite as bad as filing your taxes.

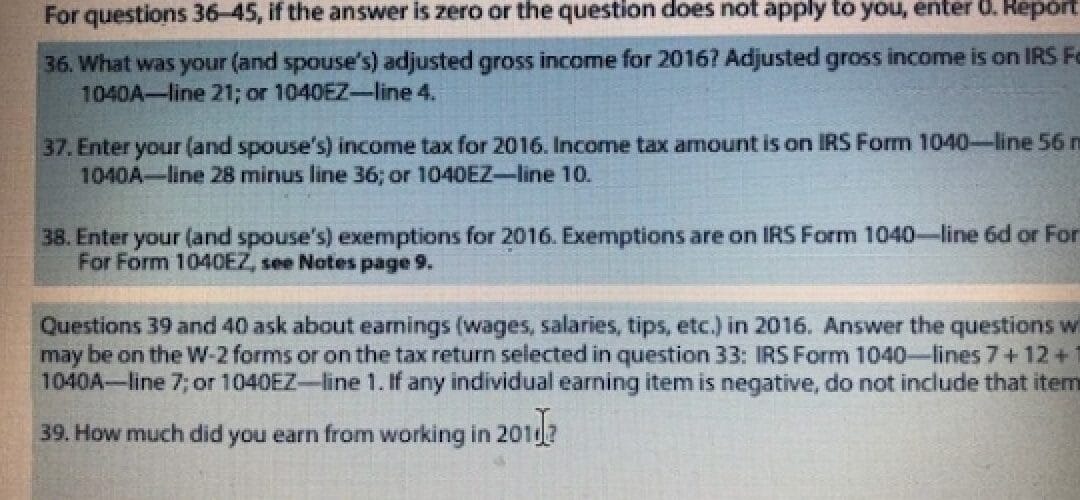

The form can be filled out via hard copy or online, and in 2018 a phone app, myStudentAid, joined the mix. A FAFSA on the Web worksheet is available to guide applicants in gathering the information they need to have on hand, which, not surprisingly, is considerable.

The primary document required is the income tax return from two years prior to the application year. A FAFSA for the 2019-20 school year, for example, would require a 2017 tax return. Generally you will need to round up the usual suspects: W-2 forms, and statements pertaining to mortgages, bank accounts, and financial instruments, including IRAs. Some families may see in this an opportunity to involve the teen student in the process as fully as possible and thereby impart some lessons in personal finance and adult responsibility. (We also recommend handling the task the same way we do our taxes: Place a stadium cushion on the floor, sit down with all of the paperwork spread out in a wide semicircle, and let the cat walk through it while you work. This is merely a personal preference and might not be suitable for everyone.)

The deadline for FAFSA submission is June 30. Corrections and updates must be filed by September 15. Individual states and individual schools have their own deadlines, which may differ from federal ones, so it is important to do your research in that area.

You’ve done it. Now what?

The next step is for the Department of Education to calculate your Estimated Family Contribution on the basis of the figures you have submitted. Applicants receive a Student Aid Report (SAR) that summarizes their data and establishes their EFC. The turnaround time is admirable: three to five days for applicants with valid email accounts and seven to ten days for those doing business via post. Colleges will have access to your data within a day of processing.

The government makes its calculations on the basis of the Federal Methodology (FM), which was established by the Higher Education Act of 1965. The FM provides for three different formulae: regular, simplified, and automatically assessed.

The regular formula, which is used in most cases, combines your assets with your earnings. According to Peterson’s:

The assets you report on your FAFSA are added to determine your family’s financial strength. (If it’s less than zero, then it’s calculated as zero.) If you own a farm or business, your net worth is adjusted to help protect these assets. The FM then waives a portion of your net worth for education savings and asset protection, and what’s left over is your discretionary net worth—basically cash and what can be converted to cash. (It’s possible that your discretionary net worth could be less than zero.) This amount is multiplied by an asset-conversion rate—the portion of your assets the federal government thinks you’ll be able to contribute to college costs. If the amount comes out as less than zero, then your asset contribution is set at zero.

The asset contribution is then combined with available income, and that total is multiplied by a variable rate: the more you have, the larger the number. The resultant EFC is one figure for an entire household, regardless of how many kids are enrolled in college.

The simplified formula omits assets from the equation, considering income only. Applicants who do not have to file income tax returns or who have filed or can file a Form 1040A or 1040EZ, and dependents of parents whose adjusted gross income is $49,999 or less, may qualify for the simplified formula.

The automatically assessed formula produces an EFC of $0 if an applicant or his/her parents do not have to file a tax return and if total adjusted gross income is $20,000 or less.

It is possible to appeal the EFC, should extenuating circumstances arise, such as unexpected loss of income, but the process lies beyond the scope of this article.

The Federal Methodology isn’t the only game in town, however. Nearly 400 schools, mostly private, require the use of the Institutional Methodology, which was developed by the College Board to help colleges “make finer distinctions about the most deserving students” and which “allows the institution to use its funds as equitably and effectively as possible,” providing “a more complete picture” of a family’s circumstances.

The IM takes into account several factors that are filtered out by the FM: farm and home equity, the assets of non-custodial divorced parents, and accounting mechanisms like capital loss and depreciation that may skew a family’s gross income downwards. Applicants for participating colleges must fill out an additional form distributed by the College Board, the CSS/Financial Aid PROFILE.

Once you have your EFC, the financial aid offices at individual institutions will subtract cost of attendance (COA) from it, COA being a combination of tuition and fees, room and board, transportation, loan fees, and miscellaneous allowable and documented expenses. EFC minus COA equals the amount of need-based aid for which you are eligible.

For non-need-based aid, colleges take the COA and subtract from it the total amount of financial aid already awarded from all sources–such as the scholarships every applicant should be diligently applying for early and often. The remaining figure is the maximum allowable amount of aid you can receive from sources such as federal loans and teacher education grants.

The old college try…

Once your FAFSA process is complete, the colleges take things from there, and each school has its own timetable for extending financial aid offers.

And speaking of timetables, we reiterate that it’s essential to start the money hunt early. The sooner you file your FAFSA and find out where you stand, the sooner you can incorporate the results into your master strategy. The Coaching Educator has nearly a decade’s worth of expertise with the process, helping students from all walks of life get into and succeed at the right college. To learn more about our philosophy and capabilities, be sure to watch our free webinars, listen to our podcasts, sign up for our four-week College App Boot Camp, consider our Ultimate Programs and our special services for athletes and performing-arts students, and book a consultation to hear what we can do for you and how we do it. Keep reading this blog, and look for us on social media (see links below) as we keep our clients and admirers advised of new developments in our effort to help students get into and succeed at the right school.

Paul Culp is certified as a global career development facilitator and writes about college admissions, college costs, financial aid, and college life in general for The Coaching Educator team. A former journalist and corporate ghostwriter, he has also been a humanities teacher at all levels from university down to sixth grade. Paul has degrees from Oxford University, Jacksonville State University, and Samford University, and also is certified as a fitness trainer. When not involved with The Coaching Educator, he stays busy plying his trade as founder and president of Shenandoah Proofreading, Editing & Composition Services (SPECS).

Recommended Reading About College Admissions and Financial Aid

Culp, Paul. “An Arm and a Leg and Your First-born Child: Why College Costs So Much, The Coaching Educator, http://tce.local/2018/09/06/an-arm-and-a-leg-and-your-first-born-child-why-college-costs-so-much/

Culp, Paul. “Free College Wouldn’t Really Be Free. Is it Coming Anyway?” The Coaching Educator, 27 March 2019, http://tce.local/2019/03/27/free-college-wouldnt-be-free-is-it-coming-anyway/

Culp, Paul. “Not So Fast, Part 2: When Scholarships Get Taken Away,” The Coaching Educator, http://tce.local/2019/02/20/not-so-fast-part-ii-why-scholarships-get-taken-away/

Culp, Paul. “The Odds Are Good But the Goods Are Odd: 16 Unusual Scholarships,” The Coaching Educator, http://tce.local/2018/10/12/the-odds-are-good-but-the-goods-are-odd-16-unusual-scholarships/

Culp, Paul “Part 2: The Odds Are Good But the Goods Are Odd: 10 More Unusual Scholarships,” The Coaching Educator, http://tce.local/2019/03/20/part-2-the-odds-are-good-but-the-goods-are-odd-10-more-unusual-scholarships/

Culp, Paul. “Types of Financial Aid: A Very Short Primer,” The Coaching Educator, 14 September 2018, http://tce.local/2018/09/14/types-of-financial-aid-a-very-short-primer/

Support smart students and spread the word:

https://www.facebook.com/thecoachingeducator

https://www.youtube.com/user/KeirinCarroll

https://twitter.com/TCEducator

https://www.instagram.com/thecoachingeducator

https://www.linkedin.com/company/thecoachingeducator

Follow us on:

YouTube: https://tinyurl.com/yy5yssq8