By Paul Culp, MA (Oxon.), CFT, GCDF, CCSP

Our friend Ronald didn’t attend college. He became a skilled tradesman and retired when he was fifty—and when the teacher who told him he’d never amount to anything without a bachelor’s degree was still working. So, college or trade school? What’ll it be?

If you know anything about The Coaching Educator, you know that our primary focus is college admissions, including the financial aid quest, and that we also serve as college success coaches for students pursuing their degrees. Nonetheless the trade school route is the most sensible one for some people, and we’ve helped many students make the college-or-trade-school decision and identify their best options. With the cost of college having long since become appalling, even amid increasing suspicion that colleges aren’t doing their jobs especially well, many students and their families are asking legitimate questions about whether trade school makes more sense than pursuing a four-year degree.

We don’t purport to proffer in one brief article the sum of all wisdom on this topic, or advice that applies to everyone. We’ll content ourselves with raising some issues that you should consider in deciding whether to go to college or trade school.

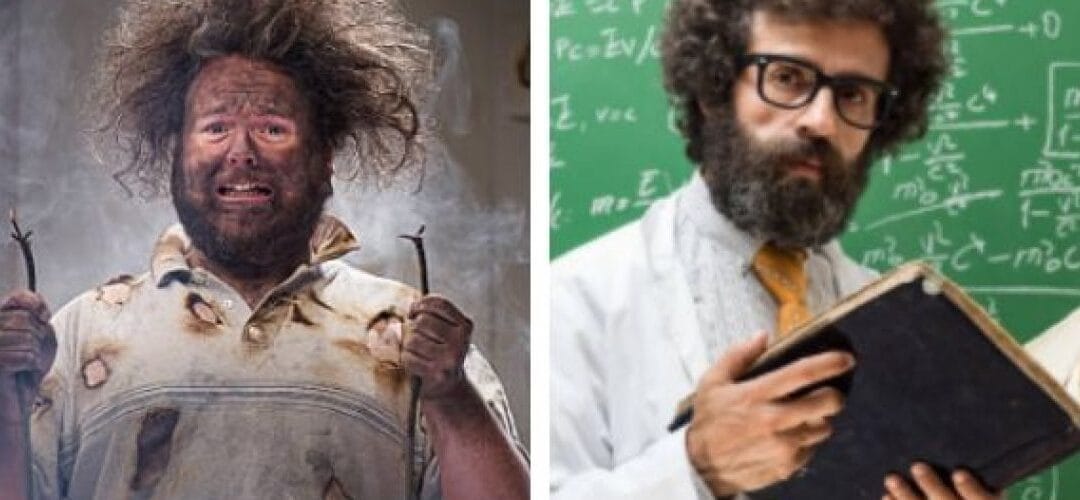

What kind of critter are you?

The most obvious question is what you want to do with your life. What type of work can you envision yourself doing? Are you the academic type, or does classroom time bore or vex you? If you fall into the latter group, you might be better off dispensing with all those electives and heavy theoretical courses and proceeding with something more hands-on that will get you into the work force faster, with a marketable skill that will hold up over time (you hope) and draw upon your interests and inclinations.

Comparative cost

The Idaho Department of Labor reports that the average cost of pursuing a bachelor’s degree is $127,000, compared with $33,000 for a trade school program or associate’s degree. The $94,000 difference is certainly eye-catching. Using the same set of data, The Simple Dollar points out that the difference doesn’t end there, because of the interest on the debt that most students will incur (unless of course The Coaching Educator helps them find and enjoy the financial aid they need). At 4 percent over 10 years, that $127,000 for a bachelor’s degree swells to $154,000, while the trade school graduate will owe $40,000. You don’t have to take business classes in night school to do the arithmetic (we hope).

Then there’s opportunity cost. A trade school graduate theoretically has the opportunity to begin his or her career sooner than the recipient of a bachelor’s degree and be paid accordingly. This brings us to…

Income after graduation

Career School Now reports that the median salary for trade school graduates at entry level is $35,720, compared with about $46,800 for holders of newly minted bachelor’s degrees. The Simple Dollar dismisses the $11,000 as “not much of a drop-off,” which prompts us to believe the dollar isn’t so simple to them after all. (Let’s not forget those night-school business courses for folks who need them.) No, $11,000 a year is quite a bit of money, especially if you project it over a long period of years.

Nonetheless the student loan issue can be a factor here, with trade school graduates making up some of that $11,000 by having lighter obligations. We also have read numerous articles by trade school advocates who reintroduce the matter of opportunity cost at this point, explaining that most college students fall behind in the earnings game by taking more than four years to complete their degrees. That they do: According to the NCES, only 60 percent of bachelor’s degree candidates finish within six years, so a high percentage of college students are vastly increasing their costs and their debts even as they lose out on time in the workforce. However, U.S. News cites the discovery by Complete College America that only 5 percent of students pursuing associate’s degrees finish on time, and only 16 percent of those pursuing a one- or two-year certificate do so.

In sum, trade school graduates may be getting out of the gate faster, but not so much faster as advocates would have us believe.

Return on investment

According to the Idaho Department of Labor and the National Center for Education Statistics, graduates of trade schools and associate’s degree programs can expect a 12:1 percent return on investment, on average, compared with 9:1 for persons earning bachelor’s degrees. That sounds wonderful. But remember, the college graduates are investing more. While the trade-schooler can expect lifetime earnings beyond high school of $393,000, college graduates on average can anticipate earning $1,102,000.

(Speaking of return on investment, clients of The Coaching Educator last year averaged a 25-fold return on their investment in our services, with a top figure of 89 times the amount spent on us.)

Vulnerability to technological disruption: Trade school OR college could leave you unprotected.

Students considering trade school obviously should do their best to consider whether technological change could render their skills obsolete sooner or later. One example of a new and highly disruptive technology is that of 3D printing, which we discussed in 3D Printing WILL Change Your Life—But How? If technology can create unemployment and underemployment even among law school graduates, as we mentioned in Sustained! The Surplus of Law School Graduates, think what it can do to people whose jobs revolve entirely around tools and machines. Will your trade disappear? Will you require expensive and time-consuming re-training? While scarcely anyone is safe in this arena, many college graduates will benefit from the additional flexibility and prestige of a four-year degree.

If you could predict the future, you could do that for a living and charge people millions of dollars per hour. As it is, predicting the future is so hard that even The Coaching Educator can’t do it. However, we’re proud of the tools at our disposal and of the expertise that we’ve developed during more than a decade of helping students follow their dreams and find a way to pay for the privilege.

Though many people in our field have no credentials in education, we have them, and we also are certified as career services professionals by the National Career Development Association and the Center for Credentialing & Education. We can help you look ahead and make the most informed choice about what to do, where, when, and with what financial assistance.

To learn more about our philosophy and capabilities, be sure to watch our free webinars, listen to our podcasts, sign up for our four-week College App Boot Camp, consider our Ultimate Programs and our special services for athletes and performing-arts students, and book a consultation to hear what we can do for you and how we do it. Keep reading this blog, and look for us on social media (see links below) as we keep our clients and admirers advised of new developments in our effort to help students get into and succeed at the right school.

Photo credit: Getty Images

Paul Culp is certified as a global career development facilitator and writes about college admissions, college costs, financial aid, and college life in general for The Coaching Educator team. A former journalist and corporate ghostwriter who now operates Shenandoah Proofreading, Editing & Composition Services (SPECS), he has also been a humanities teacher at all levels from university down to sixth grade. Paul has degrees from Oxford University, Jacksonville State University, and Samford University, and also is certified as a fitness trainer.

We hope you enjoyed “Trade School or College: What to Consider.” We also recommend the following:

Culp, Paul. “An Arm and a Leg and Your First-born Child: Why College Costs So Much, The Coaching Educator, http://tce.local/2018/09/06/an-arm-and-a-leg-and-your-first-born-child-why-college-costs-so-much/

Culp, Paul. “Beyond Tuition, Fees, and Books: The Other Costs of College,” The Coaching Educator, 7 June 2018, http://tce.local/2018/06/07/beyond-tuition-fees-and-books-the-other-costs-of-college/

Culp, Paul. “Eat Your Alphabet Soup: FAFSA, EFC, COA, and Other Delights,” The Coaching Educator, http://tce.local/2018/11/06/eat-your-alphabet-soup-fafsa-efc-coa-and-other-delights/

Culp, Paul. “‘Free College’ Wouldn’t Be Free. Is it Coming Anyway?” The Coaching Educator, 27 March 2019, http://tce.local/2019/03/27/free-college-wouldnt-be-free-is-it-coming-anyway/

Culp, Paul. “The Rise of Artificial Intelligence and the Need for Liberal Arts Education,” The Coaching Educator, http://tce.local/2018/06/07/the-rise-of-artificial-intelligence-and-the-need-for-liberal-arts-education/

Culp, Paul. “Sustained: The Surplus of Law School Graduates,” The Coaching Educator, 14 May 2019, http://tce.local/2019/05/14/sustained-the-surplus-of-law-school-graduates/

Culp, Paul. “3D Printing WILL Change Your Life—But How?” The Coaching Educator, 28 May 2019, http://tce.local/2019/05/28/3d-printing-will-change-your-life-but-how/

Culp, Paul. “Types of Financial Aid: A Very Short Primer,” The Coaching Educator, 14 September 2018, http://tce.local/2018/09/14/types-of-financial-aid-a-very-short-primer/